greene county property tax

November 2021 Property Tax Levies. This tool is provided to calculate a property tax estimate only.

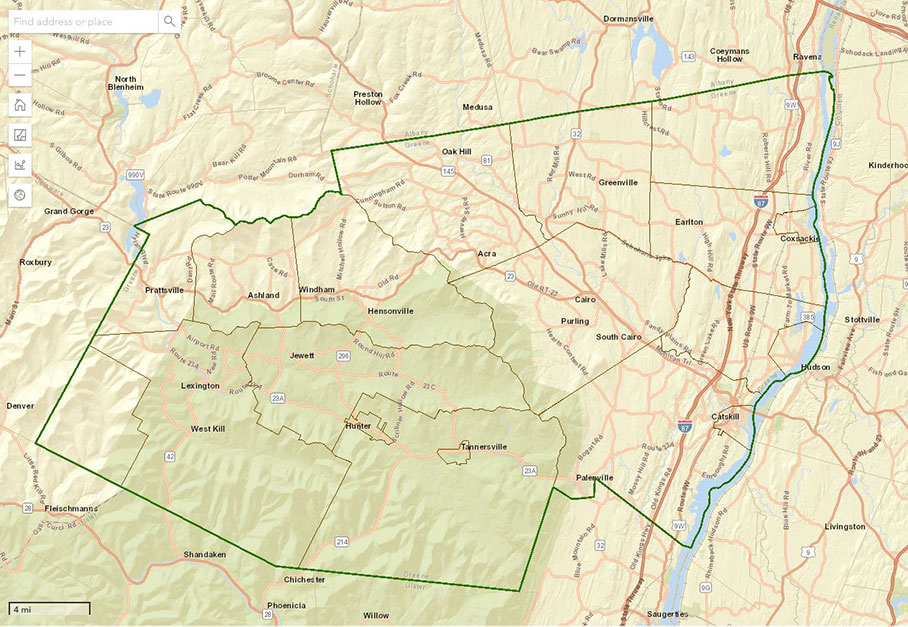

Greene County Web Map New Improved Greene Government

Welcome to the Greene County Tax Website.

. Find Greene County Home Values Property Tax Payments Annual Property Tax Collections Total and Housing Characteristics. Tax rates and reduction factors. College Street Greeneville TN 37745 Cash check debitcredit. And your personal property taxes are still due by the end of December and can.

Town of Greeneville Recorders Office Town Hall 200 N. If you have any problems or need assistance with the web site please call the Greene County Treasurers Office at. Our staff has a broad range of knowledge and experience and are pleased to share with you the many resources our department offers. Real Estate and Personal Property Tax.

Last Name First Name No punctuation. Effective property tax rates combine city county school and state tax rates into one convenient figure the annual tax for each 1000 of property at its fair market value. Enter the Owner Name or Parcel ID below and click the Search Button. This rate applies to all real and personal property land buildings equipment and inventory.

Property transfer and conveyances. The amount of property taxes you pay is based on the assessed value of your property as determined by the county property assessors office and the property tax rate set by the county commission. Box 482 Snow Hill NC 28580 3. Understanding Property Taxes in Ohio.

Welcome to the Property Search Portal. The RPTS Department is here to serve you ready to answer your questions and address your concerns. Pay your Greene County Missouri Real Estate and Personal Property taxes online using this service. Greene County Home Property Tax Statistics.

View an Example Taxcard. For real estate inquiries contact the department at 937 562-5072 or view the resources online for more information. November 26 2021 You may begin by choosing a search method below. Property Tax Payment Options.

Certain property is exempt from local property tax. The property tax rate is per hundred dollars of assessed valuation. Greene County Treasurers Office For more information about paying your property taxes or other functions of the Treasurers Office see the Treasurers Office page or call the office at. Visa MasterCard Discover and American Express accepted with a 275 convenience fee.

Greene County Real Property Tax Services provides a wide range of services from basic. The tax rates are set annually by the Greene County Board of Supervisors. Property Tax Levy Estimator. Greene County property taxes are collected annually by the trustees office.

American Community Survey 2018 ACS 5-Year Estimates. By phone at toll free number 877-690-3729 a convenience fee is applicable for debitcredit and electonic check payments. From this page click on the tax inquiry and payments tab. The Collectors office then sends out the bills.

Greene County Tax PO. Greene County Auditors Website. Collector of Revenue Allen Icet 940 N Boonville Ave Room 107 Springfield MO 65802 417 868-4036 collectorhelpgreenecountymogov. In no event will Greene County be liable for any damages including loss of data lost profits business interruption loss of business information or other pecuniary loss that might arise from the use of this information.

Our goal is to provide the people of Greene County with a website that is informative and easy to use. Greene County residents can now find their 2021 personal property and real estate tax statements online at the Greene County Collectors website. For questions regarding assessed values or adjustments please contact the Commissioner of Revenue s office. You can search our site for a wealth of information on any property in Greene County and you can securely pay your property taxes as well as renew your car tags online at your convenience.

Real Property Tax Service. The Greene County Property Search Portal created and maintained by the Greene County Assessors Office will allow residents to have online access to comprehensive information about their properties such as property characteristic or assessment history or aerial imagery. School tax information is only available on those parcels that were not paid directly to the school tax collector. You will need your Tax ID number and your PIN number which are found on your statement mailed by the Greene County Collectors office.

For actual taxes please visit the. The Commissioner of Revenue assesses property as of January 1 of each year. And residents who pay county property taxes by May 31 receive a 2 percent discount on their property tax bills. Greene County URECA - Property Search.

Delinquent school taxes are shown as a re-levy on the current year property tax bills. A convenience fee is applicable for debitcredit and electronic check payments 4. Greene County personal property statements are arriving late by mail this year but they are already available online. We collect over a quarter of a billion dollars each year and distribute the collections to nearly 40 local taxing districts such as schools cities the library etc.

Greene County Property Search. Property tax information last updated. Greene County Collector Allen Icet added that his office has successfully completed both real estate and personal property 2021 tax statements. The County Clerk uses their assessed values and the taxing district levies to calculate the tax bills.

Tax Greene County North Carolina

Don T Forget To Attend The Radon Seminar Hosted By Uga Extension Contact Or Direct Message Us For More Information Greene County University Of Georgia Greene

Just A Reminder To The Parents Of High School Students In Greene County That The Logo Rebrand Contest Ends T High School Students Greene County Just A Reminder

Collector S Office Greene County

Daily Covid 19 Updates Greene Government Greene County Ny

Greene County Personal Property And Real Estate Tax Statements Now Available Online

Komentar

Posting Komentar